Provided By: interest.com

Within three days of applying for a home loan, you'll get a Good Faith Estimate that lays out all of the terms and fees for the mortgage you want.

But are you getting the best possible deal?

The standardized GFE that the government now requires lenders to use can help you decide.

On the last of the three pages, you'll find two comparison charts that weren't on the old GFEs created by banks and mortgage companies.

The first is called the "tradeoff table" and shows what your monthly payments and closing costs might be for slightly different mortgages from the same lender.

The first option shows what you'd pay with lower settlement charges, which is great if you're short on cash, but with a slightly higher interest rate and monthly payment.

The second option is for a home loan with a lower interest rate and lower monthly mortgage payments but higher settlement charges.

The "shopping chart" allows you to compare similar loans from different lenders, including the interest rate, monthly payments and closing costs.

You can see even more comparisons like that by searching our extensive database of mortgage rates available in your area.

Even if you've already applied for a mortgage, it's not too late to put the approval process on hold and pursue a better deal.

Monday, April 22, 2013

Friday, April 19, 2013

8 smart moves to score the best possible mortgage : How to grab a great home loan

Provided By: interest.com

A great home loan can save you thousands of dollars over the life of your mortgage.

All it takes to land one is a little planning, plus some knowledge about the application process.

With this information, you'll score a house you know you can afford, discounted closing costs and a mortgage rate that will make you the envy of the neighborhood.

You might even get the seller to throw in some money to sweeten the deal.

Of course, you'll need to address the major factors that could damage your chances for mortgage approval before a lender ever sees your application.

But if you follow these 8 smart moves, you'll put yourself in position to land the best possible home loan.

A good credit score can lead the way to lower mortgage rates and more choices for loans. Lenders offer the best rates to borrowers with credit scores higher than 760.

The Fair Isaac Corporation calculates your FICO credit score based on the information in your credit reports from the three major credit bureaus. Its website (www.myfico.com) includes a table that shows how credit scores affect mortgage rates.

Credit reports often include wrong or outdated information about your credit or payment history, and those errors could lower your credit score.

That's why you should check the information kept by all three of the major credit-reporting bureaus before you apply for a loan.

To get a free credit report from Experian, TransUnion and Equifax, go to AnnualCreditReport.com.

Each report shows how to correct mistakes or submit an explanation for legitimate black marks that appear on the report.

You've probably spent months looking for the perfect home, so why not spend a few hours looking for the cheapest possible mortgage rate?

Lenders offer a surprisingly wide range of rates and fees. Finding the right loan can reduce your payments by hundreds of dollars a month and save hundreds or even thousands of dollars on up-front fees.

Our database of the best mortgage rates from scores of lenders can help you get a sense of what loans cost now.

Know that mortgage rates are about as cheap as they've ever been. So even if you score an average rate, you're getting a good deal.

Experts believe interest rates will remain below 4% on 30-year, fixed-rate home loans for most of 2013.

Even if they finish the year above 4%, they'll still be at historical lows.

It's easy to underestimate the cost of owning a home.

In addition to your mortgage payment, you'll pay property taxes, homeowners insurance, utilities, maintenance costs and possibly condo or association fees.

Use this mortgage calculator to determine how much you can afford to borrow based on your monthly income and expenses.

Add that to the amount you've set aside for a down payment, and you'll know how much you can spend on a home.

Remember, your housing costs -- including principal, interest, taxes, assessments and any other fees -- shouldn't exceed 28% of your gross or pretax income.

Banks and mortgage companies reject about half of all borrowers because they don't meet stricter demands for better credit scores, higher incomes and fewer debts.

Asking to be preapproved for a mortgage is a way to find out where you stand.

You fill out an application that asks how much you make, how much you've saved and how much you owe on everything from cars to school loans to credit cards.

The lender evaluates that information, checks your credit reports and credit scores, and replies with a letter that says you can qualify for a mortgage and how much it's willing to loan.

The process is usually free, and being preapproved boosts your credibility with real estate agents and sellers who don't want to waste their time on buyers who may not be able to get financing.

Here's our step-by-step advice on how to get preapproved.

Getting the Federal Housing Administration to guarantee your loan can be a boon for buyers having a tough time obtaining a mortgage.

You can obtain an FHA loan even if you have a smaller down payment, lower credit scores and more debt than banks and mortgage companies usually demand.

In fact, an FHA mortgage requires just a 3.5% down payment -- that's $3,500 for every $100,000 you borrow. If your FICO credit score is below 580, you'll have to come with a 10% down payment.

Most non-FHA loans require a down payment of at least 5% and often as much as 20% of the purchase price.

Rules have changed so you can borrow more money with an FHA loan than in the past.

Mortgages come with a bewildering and expensive array of expenses: loan origination fees, administrative fees, title insurance, settlement charges and so on.

You can save big by negotiating reduced fees with your lender or asking the seller to pay some of them for you.

Other ways you can save money: Pick your own surveyors, appraisers, insurers and inspection services rather than relying on the those recommended by your lender; close near the end of the month to save on prepaid interest; and make sure the costs on your Good Faith Estimate (GFE) and the settlement papers match up.

In all, those fees you'll pay once your deal is finalized can add 3% to 6% to the price of your home, depending on where you live.

Paying discount points on your mortgage is like prepaying part of the interest on your loan. You pay money up front in exchange for a lower interest rate for the life of the loan.

One point is equal to 1% of your loan. So if you're borrowing $150,000, a point would cost $1,500.

Each point you buy will knock one-eighth to one-quarter of a percentage point off your mortgage rate, which is less than points would buy a few years ago.

Buying down your interest rate makes sense only if you have extra cash available and you're likely to stay in your home long enough to recoup the up-front cost.

After all, it could take years to break even.

Our mortgage points calculator allows you to decide whether you're better off paying points to lower your interest rate or adding that money to your down payment.

One way to lower the cost of your home loan at no cost to yourself is to ask the sellers to pay the points on your mortgage.

You get a lower monthly payment and need less income to qualify for the mortgage.

Paying your points can also cost sellers less than reducing the price of their home.

Say you want to buy a $375,000 home with 20% down. A $300,000 30-year, fixed-rate mortgage at 4% means a monthly payment of $1,432.

A 5% sales price reduction costs the seller $18,750. The loan amount drops to $285,000, which decreases your monthly payment to $1,361. You'll save save $71 each month on your payment.

Paying three discount points on your mortgage costs the seller only $12,000. Your loan amount is still $300,000, but your rate could drop to 3.25%. Now your monthly payment is $1,306, a savings of $126 from the original deal.

A great home loan can save you thousands of dollars over the life of your mortgage.

All it takes to land one is a little planning, plus some knowledge about the application process.

With this information, you'll score a house you know you can afford, discounted closing costs and a mortgage rate that will make you the envy of the neighborhood.

You might even get the seller to throw in some money to sweeten the deal.

Of course, you'll need to address the major factors that could damage your chances for mortgage approval before a lender ever sees your application.

But if you follow these 8 smart moves, you'll put yourself in position to land the best possible home loan.

A good credit score can lead the way to lower mortgage rates and more choices for loans. Lenders offer the best rates to borrowers with credit scores higher than 760.

The Fair Isaac Corporation calculates your FICO credit score based on the information in your credit reports from the three major credit bureaus. Its website (www.myfico.com) includes a table that shows how credit scores affect mortgage rates.

Credit reports often include wrong or outdated information about your credit or payment history, and those errors could lower your credit score.

That's why you should check the information kept by all three of the major credit-reporting bureaus before you apply for a loan.

To get a free credit report from Experian, TransUnion and Equifax, go to AnnualCreditReport.com.

Each report shows how to correct mistakes or submit an explanation for legitimate black marks that appear on the report.

You've probably spent months looking for the perfect home, so why not spend a few hours looking for the cheapest possible mortgage rate?

Lenders offer a surprisingly wide range of rates and fees. Finding the right loan can reduce your payments by hundreds of dollars a month and save hundreds or even thousands of dollars on up-front fees.

Our database of the best mortgage rates from scores of lenders can help you get a sense of what loans cost now.

Know that mortgage rates are about as cheap as they've ever been. So even if you score an average rate, you're getting a good deal.

Experts believe interest rates will remain below 4% on 30-year, fixed-rate home loans for most of 2013.

Even if they finish the year above 4%, they'll still be at historical lows.

It's easy to underestimate the cost of owning a home.

In addition to your mortgage payment, you'll pay property taxes, homeowners insurance, utilities, maintenance costs and possibly condo or association fees.

Use this mortgage calculator to determine how much you can afford to borrow based on your monthly income and expenses.

Add that to the amount you've set aside for a down payment, and you'll know how much you can spend on a home.

Remember, your housing costs -- including principal, interest, taxes, assessments and any other fees -- shouldn't exceed 28% of your gross or pretax income.

Banks and mortgage companies reject about half of all borrowers because they don't meet stricter demands for better credit scores, higher incomes and fewer debts.

Asking to be preapproved for a mortgage is a way to find out where you stand.

You fill out an application that asks how much you make, how much you've saved and how much you owe on everything from cars to school loans to credit cards.

The lender evaluates that information, checks your credit reports and credit scores, and replies with a letter that says you can qualify for a mortgage and how much it's willing to loan.

The process is usually free, and being preapproved boosts your credibility with real estate agents and sellers who don't want to waste their time on buyers who may not be able to get financing.

Here's our step-by-step advice on how to get preapproved.

Getting the Federal Housing Administration to guarantee your loan can be a boon for buyers having a tough time obtaining a mortgage.

You can obtain an FHA loan even if you have a smaller down payment, lower credit scores and more debt than banks and mortgage companies usually demand.

In fact, an FHA mortgage requires just a 3.5% down payment -- that's $3,500 for every $100,000 you borrow. If your FICO credit score is below 580, you'll have to come with a 10% down payment.

Most non-FHA loans require a down payment of at least 5% and often as much as 20% of the purchase price.

Rules have changed so you can borrow more money with an FHA loan than in the past.

Mortgages come with a bewildering and expensive array of expenses: loan origination fees, administrative fees, title insurance, settlement charges and so on.

You can save big by negotiating reduced fees with your lender or asking the seller to pay some of them for you.

Other ways you can save money: Pick your own surveyors, appraisers, insurers and inspection services rather than relying on the those recommended by your lender; close near the end of the month to save on prepaid interest; and make sure the costs on your Good Faith Estimate (GFE) and the settlement papers match up.

In all, those fees you'll pay once your deal is finalized can add 3% to 6% to the price of your home, depending on where you live.

Paying discount points on your mortgage is like prepaying part of the interest on your loan. You pay money up front in exchange for a lower interest rate for the life of the loan.

One point is equal to 1% of your loan. So if you're borrowing $150,000, a point would cost $1,500.

Each point you buy will knock one-eighth to one-quarter of a percentage point off your mortgage rate, which is less than points would buy a few years ago.

Buying down your interest rate makes sense only if you have extra cash available and you're likely to stay in your home long enough to recoup the up-front cost.

After all, it could take years to break even.

Our mortgage points calculator allows you to decide whether you're better off paying points to lower your interest rate or adding that money to your down payment.

One way to lower the cost of your home loan at no cost to yourself is to ask the sellers to pay the points on your mortgage.

You get a lower monthly payment and need less income to qualify for the mortgage.

Paying your points can also cost sellers less than reducing the price of their home.

Say you want to buy a $375,000 home with 20% down. A $300,000 30-year, fixed-rate mortgage at 4% means a monthly payment of $1,432.

A 5% sales price reduction costs the seller $18,750. The loan amount drops to $285,000, which decreases your monthly payment to $1,361. You'll save save $71 each month on your payment.

Paying three discount points on your mortgage costs the seller only $12,000. Your loan amount is still $300,000, but your rate could drop to 3.25%. Now your monthly payment is $1,306, a savings of $126 from the original deal.

Wednesday, April 17, 2013

The $1,382 reason to scrutinize your closing statement

Provided By:interest.com

I've bought and sold enough houses to expect my closing statement to show all kinds of charges, most of which make little sense to me.

There is, for example, $9.50 for flood data services and $77 for tax services. (Whose taxes? What am I getting for these tax services? Nobody says.)

I've accepted these charges as part of doing business.

When my husband, Gary, and I purchased our current home through a short sale, we came to the closing table agreeing that, unless something was way out of line, we'd just sign the document and get our house.

With luck, this is the last piece of real estate we will ever buy.

We signed, and we signed. I pointed out that I wrote a book a lot lighter than this sheaf of paper we were signing.

No, we did not read every word like I tell people to do. That would have taken all night.

We did read every line of the settlement statement — the summary of every dollar amount that affects the transaction. It's a good thing we did.

The first item that stood out was a $1,000 charge for the septic pump certification fee. We had agreed to pay the septic fee as part of the deal.

However, we had already paid it on our credit card. Gary pointed that out to the loan officer, who agreed that we should be refunded that amount. (We since have received a refund.)

Next, we read a line called "Buyer credit to seller for tax proration" for $1,382.52.

We asked the loan officer what that was, and she searched until she found an email from the short sale negotiator.

It said that Bank of America had agreed to the sale only if it received a certain dollar amount, and because the closing date had been extended, the property taxes that had accrued in the meantime were a problem. The negotiator suggested in the email the buyers should pay that, because it was "their fault" that the closing was delayed.

Because there was no explanation in the closing packet about the "buyer credit to seller," we couldn't close until someone hurriedly typed up an addendum and placed it before us for signing.

We were told that if we didn't sign, we would lose the house.

We already had quite an investment of time and money, including the $1,000 septic fee, so we signed.

Several people, including our loan officer, advised us that we would be able to get that money back later because it was illegal for them to add it at the closing table.

So far, however, we haven't had any luck.

Moral of the story: Read the closing statement, and make sure you understand every line.

Several people work on your closing file, and not all of them are familiar with what's been paid or by whom.

You may be able to resolve some surprise charges but not others, but it's always better to at least know where your money went than to close your eyes and sign.

I've bought and sold enough houses to expect my closing statement to show all kinds of charges, most of which make little sense to me.

There is, for example, $9.50 for flood data services and $77 for tax services. (Whose taxes? What am I getting for these tax services? Nobody says.)

I've accepted these charges as part of doing business.

When my husband, Gary, and I purchased our current home through a short sale, we came to the closing table agreeing that, unless something was way out of line, we'd just sign the document and get our house.

With luck, this is the last piece of real estate we will ever buy.

We signed, and we signed. I pointed out that I wrote a book a lot lighter than this sheaf of paper we were signing.

No, we did not read every word like I tell people to do. That would have taken all night.

We did read every line of the settlement statement — the summary of every dollar amount that affects the transaction. It's a good thing we did.

Common Closing Costs

| Down payment | Loan origination |

| Points | Home inspection |

| Appraisal | Credit report |

| Private mortgage insurance | Insurance escrow |

| Property tax escrow | Deed recording |

| Title insurance premium | Land survey |

| Notary fees | Prorations on utility bills, property taxes |

The first item that stood out was a $1,000 charge for the septic pump certification fee. We had agreed to pay the septic fee as part of the deal.

However, we had already paid it on our credit card. Gary pointed that out to the loan officer, who agreed that we should be refunded that amount. (We since have received a refund.)

Next, we read a line called "Buyer credit to seller for tax proration" for $1,382.52.

We asked the loan officer what that was, and she searched until she found an email from the short sale negotiator.

It said that Bank of America had agreed to the sale only if it received a certain dollar amount, and because the closing date had been extended, the property taxes that had accrued in the meantime were a problem. The negotiator suggested in the email the buyers should pay that, because it was "their fault" that the closing was delayed.

Because there was no explanation in the closing packet about the "buyer credit to seller," we couldn't close until someone hurriedly typed up an addendum and placed it before us for signing.

We were told that if we didn't sign, we would lose the house.

We already had quite an investment of time and money, including the $1,000 septic fee, so we signed.

Several people, including our loan officer, advised us that we would be able to get that money back later because it was illegal for them to add it at the closing table.

So far, however, we haven't had any luck.

Moral of the story: Read the closing statement, and make sure you understand every line.

Several people work on your closing file, and not all of them are familiar with what's been paid or by whom.

You may be able to resolve some surprise charges but not others, but it's always better to at least know where your money went than to close your eyes and sign.

Monday, April 15, 2013

Secrets to paying off a mortgage in 10 years

Provided By: interest.com

Katie and John Johnson were newlyweds in August 2003 when they borrowed $205,000 for their Salem, Ore., home.

Just nine years and a dachshund later, they’re counting down to their final mortgage payment.

"I think it will feel really good," Katie says of the May 2013 milestone. "We’re looking forward to the next goal."

So what's this couple's secret?

Katie, 35, and John, 49, have taken an aggressive approach to paying off their loan.

Today, they pay thousands of dollars more to their lender each month than they're required to. Over time, as they've retired other debts and earned more income, they've gradually increased payments. (Read our 3 free ways to pay your home loan faster for more tips.)

Katie, a civil engineer with the state of Oregon, and John, a federal aid highway program construction specialist with the state, initially had two mortgages.

The Johnsons had taken out the second home loan so they could avoid paying private mortgage insurance, because their down payment was less than 20% of the sale price of the home.

Their first mortgage, a 30-year, fixed-rate loan for $173,000, is the one they’re about to pay off. It carries an interest rate of 4.875% and a monthly payment of just over $900.

The second mortgage, a 15-year balloon loan for $32,000, charged 8% interest and a monthly payment of about $200.

"We attacked that one aggressively," Katie says.

Katie admits the thought of being stuck with a large payment at the end of the balloon loan made her nervous.

The Johnsons immediately began paying an extra $110 a month toward the balloon loan's principal, which they bumped up to an extra $350 a month in 2004.

Later that year, they made a lump-sum payment of $4,000 and also upped their monthly payment to $512.

At the same time, the couple began paying an additional $85 a month on their 30-year loan.

Katie and John were able to increase their monthly payments after they paid off an auto loan and when they each earned cost-of-living raises.

The Johnsons figured they were already used to living without the extra income so wouldn't miss the additional cash.

They made the lump-sum payments from savings, because their regular contributions weren't earning enough interest to justify maintaining a large balance.

By 2006, the Johnsons were paying an extra $862 a month on the 15-year balloon loan and that December made a lump-sum payment of just over $5,000 to pay it off.

By 2006, the Johnsons were paying an extra $862 a month on the 15-year balloon loan and that December made a lump-sum payment of just over $5,000 to pay it off.

They rang in 2007 with only their 30-year loan and — again applying their we-won’t-miss-what-we-never-had principle — began paying an extra $1,200 a month, for a total payment of $2,100.

In 2010, they added another $1,000, for a monthly total of $3,100.

"That will take us to the end," Katie says. "We’ll have it paid off in May of 2013 on that schedule."

To help the countdown, she created an amortization table and crosses off each month after they make their payment.

"This last part is very fun, to actually get to the very end," she says.

Katie says that only having house debt has made their aggressive payoff plan possible.

While the Johnsons use credit cards, they pay the balance in full every month. They also save up for big purchases, like their annual vacation to Hawaii, instead of charging them.

The couple also eats at home the vast majority of time and avoids paying for a gym membership by running outside for exercise.

"Our standard of living is really comfortable," Katie says. "We don’t go without anything, and we do have those times when we have fun."

When the Johnsons no longer have a house payment, they plan to treat themselves to a new mattress and perhaps a cruise.

After that, they’ll boost their emergency savings and retirement account contributions, Katie says, and then start saving to either build a home or buy a vacation home.

The Johnsons’ tips for paying off a loan early:

Katie and John Johnson were newlyweds in August 2003 when they borrowed $205,000 for their Salem, Ore., home.

Just nine years and a dachshund later, they’re counting down to their final mortgage payment.

"I think it will feel really good," Katie says of the May 2013 milestone. "We’re looking forward to the next goal."

So what's this couple's secret?

Katie, 35, and John, 49, have taken an aggressive approach to paying off their loan.

Today, they pay thousands of dollars more to their lender each month than they're required to. Over time, as they've retired other debts and earned more income, they've gradually increased payments. (Read our 3 free ways to pay your home loan faster for more tips.)

Katie, a civil engineer with the state of Oregon, and John, a federal aid highway program construction specialist with the state, initially had two mortgages.

The Johnsons had taken out the second home loan so they could avoid paying private mortgage insurance, because their down payment was less than 20% of the sale price of the home.

Their first mortgage, a 30-year, fixed-rate loan for $173,000, is the one they’re about to pay off. It carries an interest rate of 4.875% and a monthly payment of just over $900.

The second mortgage, a 15-year balloon loan for $32,000, charged 8% interest and a monthly payment of about $200.

"We attacked that one aggressively," Katie says.

Pay early, save big on your $200,000 home loan

| Extra annual payments | Interest paid | Savings | Payoff time |

| $0 | $124,117 | $0 | 30 years |

| $900 | $106,988 | $17,129 | 26 years, 3 months |

| $1,800 | $94,259 | $29,858 | 23 years, 5 months |

| $2,700 | $84,398 | $39,719 | 21 years, 1 month |

| Source: Interest.com mortgage calculator. |

The Johnsons immediately began paying an extra $110 a month toward the balloon loan's principal, which they bumped up to an extra $350 a month in 2004.

Later that year, they made a lump-sum payment of $4,000 and also upped their monthly payment to $512.

At the same time, the couple began paying an additional $85 a month on their 30-year loan.

Katie and John were able to increase their monthly payments after they paid off an auto loan and when they each earned cost-of-living raises.

The Johnsons figured they were already used to living without the extra income so wouldn't miss the additional cash.

They made the lump-sum payments from savings, because their regular contributions weren't earning enough interest to justify maintaining a large balance.

By 2006, the Johnsons were paying an extra $862 a month on the 15-year balloon loan and that December made a lump-sum payment of just over $5,000 to pay it off.

By 2006, the Johnsons were paying an extra $862 a month on the 15-year balloon loan and that December made a lump-sum payment of just over $5,000 to pay it off.They rang in 2007 with only their 30-year loan and — again applying their we-won’t-miss-what-we-never-had principle — began paying an extra $1,200 a month, for a total payment of $2,100.

In 2010, they added another $1,000, for a monthly total of $3,100.

"That will take us to the end," Katie says. "We’ll have it paid off in May of 2013 on that schedule."

To help the countdown, she created an amortization table and crosses off each month after they make their payment.

"This last part is very fun, to actually get to the very end," she says.

Katie says that only having house debt has made their aggressive payoff plan possible.

While the Johnsons use credit cards, they pay the balance in full every month. They also save up for big purchases, like their annual vacation to Hawaii, instead of charging them.

The couple also eats at home the vast majority of time and avoids paying for a gym membership by running outside for exercise.

"Our standard of living is really comfortable," Katie says. "We don’t go without anything, and we do have those times when we have fun."

When the Johnsons no longer have a house payment, they plan to treat themselves to a new mattress and perhaps a cruise.

After that, they’ll boost their emergency savings and retirement account contributions, Katie says, and then start saving to either build a home or buy a vacation home.

The Johnsons’ tips for paying off a loan early:

- Set a goal. The couple was determined from the get-go to have their loans paid off before the due dates.

- Pay more than the minimum. Katie says they initially figured out that paying just $110 extra a month on their 15-year balloon loan would prevent them from being stuck with a big payment at the loan's end.

- Keep track. Katie created and updated amortization charts on their loans so they could see their progress. And stay motivated

Friday, April 5, 2013

The Low-Down On Big Down Payments

Provided By Realty Times

Low-down payment mortgages are an effort to extend home ownership to more people and to help some out of mortgages they can’t afford.

However, low-down payment loans can be tricky and leave homeowners struggling to pay what they thought was affordable financing.

It’s a much better option to bite the bullet, spend some time really preparing to buy a home with 20 percent down.

Here’s why.

Up-front equity. A substantial down payment gives you an instant equityadvantage.Most homeowners invest in a home largely because they want to have equity in a stable investment so, the more that you can put down, the better.

You’ll be able to better weather any downturns in the market and you’ll likely avoid going "underwater" (owing more than your home is worth) on your investment.

That gives you some financial security.

Better rates. Generally, more money down means you’ll be able to secure a better interest rate. With 20 percent or more down, you’re a better risk to your lender because you’ve already proven a degree of financial responsibility with the respectable down payment amount. You’ll also lower your monthly payment by paying more up front.

Seller attraction. Sellers like buyers who can offer a certain amount up front. It shows that you can deliver on the sale – and it also gives you leverage in case of a bidding war. In short, the seller will take your offer more seriously.

No mortgage insurance. You won’t have to pay mortgage insurance if you put 20 percent or more down, because lenders consider your loan less risky than a loan with 20 percent down.

Once you get mortgage insurance you’ll have to pay for it until you’ve paid down the mortgage until it is 80 percent of the value of your home. Some Federal Housing Administration loans will never let you remove mortgage insurance.

Without mortgage insurance you’ll save an amount equal to about 0.5 percent of your loan balance each year.

The fast track. With 20 percent to put down, you’ll be able to pay off your mortgage sooner, especially if you take advantage of refinancing options in the future.The current housing recovery is underway and that brings the possibility that home prices will rise enough so that you can move up to a larger home or refinance to a shorter-term loan.

It’s not possible for every home buyer to put 20 percent down. Don’t be discouraged is you can’t. Just understand the risks associated with the extra costs and more financial risk associated with a low-down loan.

If, however, you believe you can join the 20 percent-down crowd, go for it. It’s better to wait for a mortgage you can afford, than to over leverage yourself into a mortgage that will cause a struggle.

You can buy a home with as little as 3 percent down, thanks to federal government loans and others with eased restrictions.

However, low-down payment loans can be tricky and leave homeowners struggling to pay what they thought was affordable financing.

It’s a much better option to bite the bullet, spend some time really preparing to buy a home with 20 percent down.

Here’s why.

You’ll be able to better weather any downturns in the market and you’ll likely avoid going "underwater" (owing more than your home is worth) on your investment.

That gives you some financial security.

Without mortgage insurance you’ll save an amount equal to about 0.5 percent of your loan balance each year.

It’s not possible for every home buyer to put 20 percent down. Don’t be discouraged is you can’t. Just understand the risks associated with the extra costs and more financial risk associated with a low-down loan.

If, however, you believe you can join the 20 percent-down crowd, go for it. It’s better to wait for a mortgage you can afford, than to over leverage yourself into a mortgage that will cause a struggle.

Wednesday, April 3, 2013

Bathroom floor tiles: Which material is best for y

Provided By Yahoo! Real Estate

Bathroom floor tile is available in a surprising number of materials. Ceramic, porcelain, and vinyl tiles are what come to mind first, and for good reason: They are the most popular choices and perhaps the most practical. But there are many options available today, from wood and cork to stone and glass. Here is a quick guide to help you determine the best floor tile for your bath.

VINYL TILES

Vinyl is the most popular bathroom flooring material, because of its low cost and high degree of practicality. It is well-suited for every bathroom in the house, from the master bath to the powder room. Hands down, it beats other popular choices for safety, comfort, and durability. Almost as important, vinyl tiles have come a long way in aesthetic appeal and ease of installation. The material is self-adhering and can be cut with a utility knife. Prices start at $.95 per square foot.

Vinyl is the most popular bathroom flooring material, because of its low cost and high degree of practicality. It is well-suited for every bathroom in the house, from the master bath to the powder room. Hands down, it beats other popular choices for safety, comfort, and durability. Almost as important, vinyl tiles have come a long way in aesthetic appeal and ease of installation. The material is self-adhering and can be cut with a utility knife. Prices start at $.95 per square foot.

CERAMIC AND PORCELAIN TILES

Nothing looks better than ceramic or porcelain, whether your tastes run to stone or wood lookalikes or brilliant colors and surprising patterns. Ceramics score high with regard to maintenance, too, but they are not nearly as comfortable to the bare foot as vinyl. Installing radiant floor heat helps to change that, but a hard surface is hard whether or not it's warm. Ceramics are not as easy to install as vinyl, though it is a job the adventurous do-it-yourselfer can tackle. When protected with a high-grade glaze, ceramic will resist wear and scratches. Porcelain tiles are harder than clay-based tiles and may have through-body color, an advantage if chipping occurs. Prices start at around $1.09 per square foot.

Nothing looks better than ceramic or porcelain, whether your tastes run to stone or wood lookalikes or brilliant colors and surprising patterns. Ceramics score high with regard to maintenance, too, but they are not nearly as comfortable to the bare foot as vinyl. Installing radiant floor heat helps to change that, but a hard surface is hard whether or not it's warm. Ceramics are not as easy to install as vinyl, though it is a job the adventurous do-it-yourselfer can tackle. When protected with a high-grade glaze, ceramic will resist wear and scratches. Porcelain tiles are harder than clay-based tiles and may have through-body color, an advantage if chipping occurs. Prices start at around $1.09 per square foot.

PLASTIC LAMINATE TILES

Plastic laminate tiles (more commonly available as planks) are also a good choice, especially if you're remodeling. Similar to the laminate material that covered kitchen countertops for a generation or two, the tiles don't significantly raise the height of the existing floor, which makes it easier to plan transitions from room to room. While durable and easy to keep clean, laminate falls short when it comes to moisture. Standing water can infiltrate the fiberboard core, causing the material to expand and buckle. With laminates, it's critical to caulk gaps along the walls, around the tub, and surrounding other fixtures to prevent water infiltration. Another con: Laminates don't come in the same variety of styles you'll find with ceramics and vinyl. From $.49 per square foot.

Plastic laminate tiles (more commonly available as planks) are also a good choice, especially if you're remodeling. Similar to the laminate material that covered kitchen countertops for a generation or two, the tiles don't significantly raise the height of the existing floor, which makes it easier to plan transitions from room to room. While durable and easy to keep clean, laminate falls short when it comes to moisture. Standing water can infiltrate the fiberboard core, causing the material to expand and buckle. With laminates, it's critical to caulk gaps along the walls, around the tub, and surrounding other fixtures to prevent water infiltration. Another con: Laminates don't come in the same variety of styles you'll find with ceramics and vinyl. From $.49 per square foot.

STONE TILES

Stone tiles were once confined to the foyer. In the past decade, however, they have become popular in other rooms as well, bathroom included. Made from limestone, marble, granite and slate, stone tiles are available in colors that range from creams to blues, reds, greens and golds. Available textures are nearly as numerous and include cleft, tumbled, sandblasted, etched and flamed variations. Stone requires more maintenance than ceramic tile; regular cleaning and sealing are recommended. Plus, stone is typically more expensive than similar-looking ceramic or porcelain tiles. Prices vary.

Stone tiles were once confined to the foyer. In the past decade, however, they have become popular in other rooms as well, bathroom included. Made from limestone, marble, granite and slate, stone tiles are available in colors that range from creams to blues, reds, greens and golds. Available textures are nearly as numerous and include cleft, tumbled, sandblasted, etched and flamed variations. Stone requires more maintenance than ceramic tile; regular cleaning and sealing are recommended. Plus, stone is typically more expensive than similar-looking ceramic or porcelain tiles. Prices vary.

WOOD FLOOR TILES

Wood is only for the fearless. Once water penetrates the finish, it will stain—probably for good. During installation, the wood parquet tiles must be carefully sealed around the room perimeter and at all other joints. Two coats of polyurethane must then be applied as protection. Use it in a powder room but avoid wood floor tile in full baths that get a lot of use. Prices vary.

Wood is only for the fearless. Once water penetrates the finish, it will stain—probably for good. During installation, the wood parquet tiles must be carefully sealed around the room perimeter and at all other joints. Two coats of polyurethane must then be applied as protection. Use it in a powder room but avoid wood floor tile in full baths that get a lot of use. Prices vary.

LINOLEUM FLOOR TILES

Linoleum is made of linseed oil, cork powder, wood flour, ground limestone and pigments. It is at home in contemporary or retro settings and well-suited to the bathroom. It's touted as naturally inhibiting the growth of microorganisms and being able to repel dust and dirt, all while retaining its color. In my experience, that's hype. Click-in-place plank designs make it easy to install, and there is no doubt that the stuff looks great. The look comes at a cost, however, as linoleum is relatively expensive. Average cost per square foot: $4.

Linoleum is made of linseed oil, cork powder, wood flour, ground limestone and pigments. It is at home in contemporary or retro settings and well-suited to the bathroom. It's touted as naturally inhibiting the growth of microorganisms and being able to repel dust and dirt, all while retaining its color. In my experience, that's hype. Click-in-place plank designs make it easy to install, and there is no doubt that the stuff looks great. The look comes at a cost, however, as linoleum is relatively expensive. Average cost per square foot: $4.

CORK TILES

Cork is warm to the touch and very easy on the feet, and the tiles come tinted in a variety of colors. Installation is not difficult, but if you purchase unfinished tiles, expect to protect them with two coats of polyurethane. Generally, cork tiles are installed with a troweled-on adhesive, but click-in-place floating floor products are also available. Average cost: $2 per square foot.

Cork is warm to the touch and very easy on the feet, and the tiles come tinted in a variety of colors. Installation is not difficult, but if you purchase unfinished tiles, expect to protect them with two coats of polyurethane. Generally, cork tiles are installed with a troweled-on adhesive, but click-in-place floating floor products are also available. Average cost: $2 per square foot.

GLASS TILES

Glass floor tile is about as different as you can get. Installed properly, this type of tile holds up well and if textured, it can resist slips. Smallglass tiles with lots of grout joints are also slip-resistant. The aesthetic appeal is twofold: Covering the floor in a thin layer of glass creates the illusion of depth, and if the glass is tinted, you get a lovely stained-glass effect. Prices vary.

Glass floor tile is about as different as you can get. Installed properly, this type of tile holds up well and if textured, it can resist slips. Smallglass tiles with lots of grout joints are also slip-resistant. The aesthetic appeal is twofold: Covering the floor in a thin layer of glass creates the illusion of depth, and if the glass is tinted, you get a lovely stained-glass effect. Prices vary.

Tips: When buying glass, ceramic, or porcelain tile, be sure it's rated for use on floors. Choose ceramic tile with a grade of 1 or 2 for floors. Ceramic tile also comes with a coefficient of friction (COF). For safety, choose one rated .50 or greater. The Porcelain Enamel Institute (PEI) rating system counts the other way; opt for tiles that are at least PEI III.

Monday, April 1, 2013

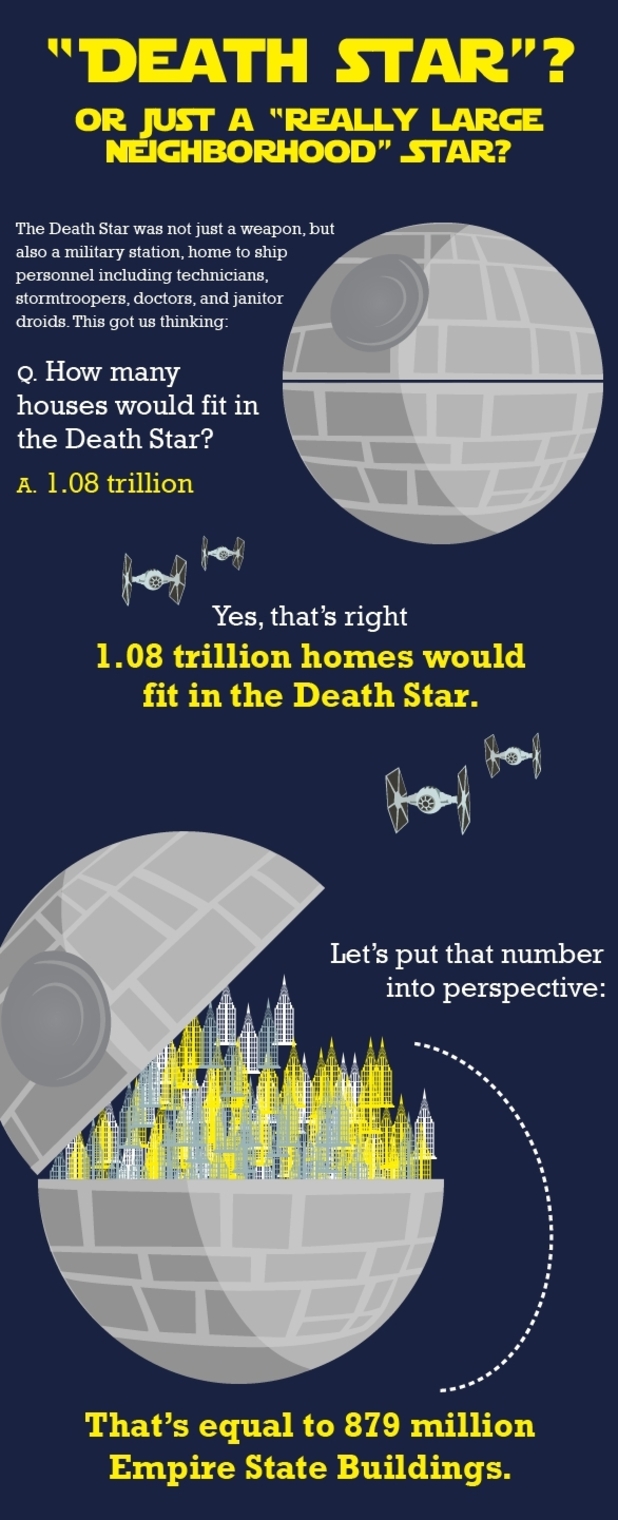

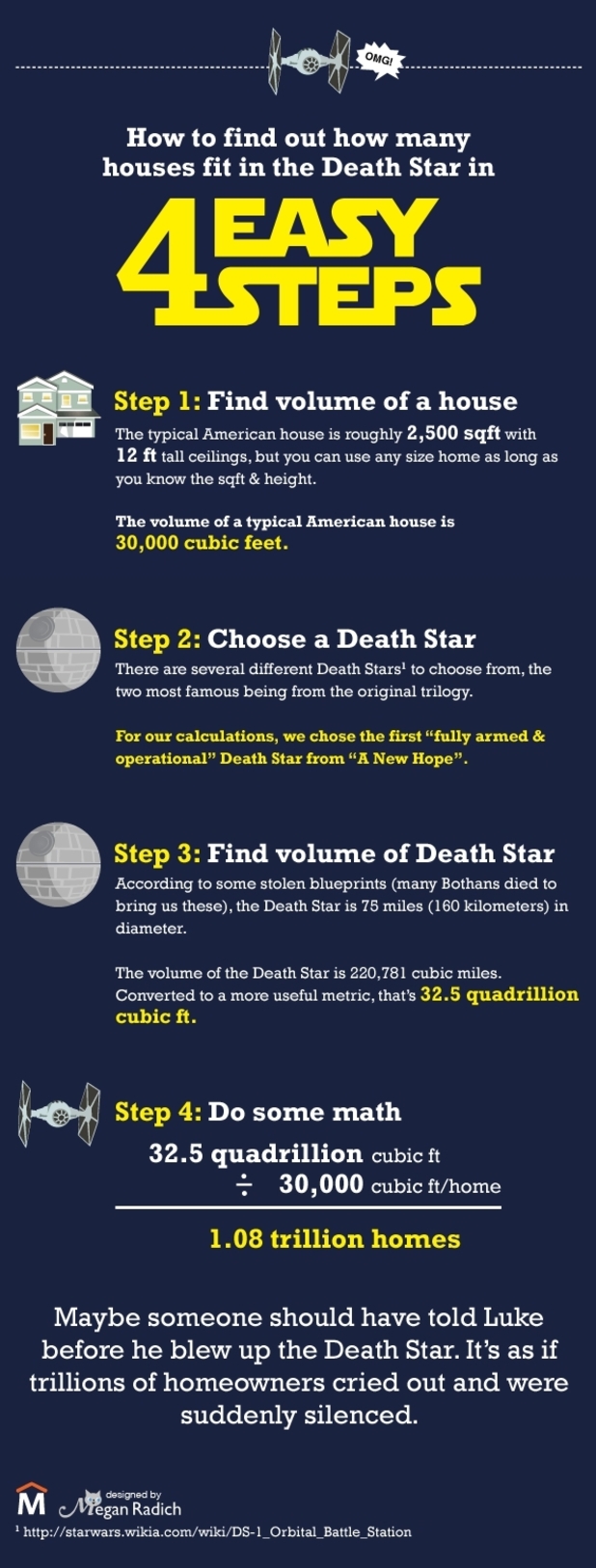

'Star Wars': How many houses can you fit inside the Death Star?

Provided By Digital Spy

© Movoto

© Movoto

Subscribe to:

Posts (Atom)